Bitcoin Cash gives you full throttle: 15% price increase within 24h

The little brother of Bitcoin, Bitcoin Cash, has planned a hard fork for the 15.11.2018. Some of the world’s major stock exchanges, including Coinbase, have announced their full support for the fork.

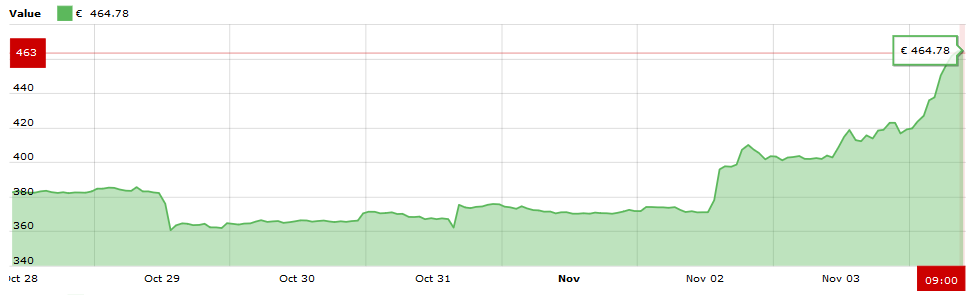

Within the last 24 hours, the price of Bitcoin Cash rose by 15.64 percent to a price of 468.30 euros. The trading volume also showed a clear impulse and rose to just under 793.266 euros.

The rest of the market is moving sideways, as usual in recent weeks, and shows no big changes in prices.

On 15.11.2018 a hard fork will take place, which “ABC”, the former developers of Bitcoin Cash Software, will carry out. After Bitcoin.com and Binance announced their full support, Bitcoin Cash’s course began to gain momentum a few days ago.

Gestern has announced that Coinbase will fully support the Hard Fork as well. Within the next few days, the Exchange will set up all the necessary technical measures and interfaces to ensure that everything runs smoothly (freely translated):

The Bitcoin Cash (BCH) network gives a fixed place twice a year as part of the planned protocol upgrades. The next BCH Hard Fork is scheduled for November 15, 2018, and Coinbase is ready to support the Bitcoincash.org roadmap. However, unlike previous BCH hard forks, there is one competing proposal that is not compatible with this published roadmap.

In the past, the price of crypto currencies has often risen in front of a hard fork. In the case of a hard fork, the owners of the forged digital currencies are rewarded 1:1 with the new crypto currency and thus receive their coins “as a gift”. It remains to be seen how long this short “hype” will last.

According to technical analyst Eric Thies, crypto currencies have not shown such low volatility in such an event in the past, from correction to accumulation phase. Due to the low market volume, almost all crypto currencies remained stable at a relatively low price level and showed little movement (freely translated):

The historical volatility level (per CMC) of one week reached this low in the bear market in 2014 only in the middle of the accumulation phase. Surprisingly, volatility did not bottom out until the price was already +155% below the low trend.

Although the current stabilization phase is a good sign for the crypto market, the low volume indicates a continued sideways movement. Here you have to wait and see whether signed events, such as the start of the stock exchange bakkt, can initiate an upswing.