Canada’s supervision gives the green light for BTC-Fund on the TSX

An important step for the market of the crypto-Fund in Canada: The local supervision of the TSX a Fund for all interested investors.

Long preparation time has led to the success

When it comes to Fund in the context of digital currencies such as Bitcoin, the regulators around the world continue to. The many state bodies will little continue to keep the way of digital Assets, i.e., assets. The Toronto Stock Exchange (TSX) is currently allowed to claim a success. Or in other words: The asset Manager 3iQ from Canada accomplished what was denied to other service providers with similar plans around the Bitcoin or Altcoins like Ethereum and Litecoin so far. The company reported currently pleased that a new BTC-Fund has received a positive decision on the Listing application to the stock exchange.According to the statements of the provider, it took less than three years, until the new product has finally received the approval.

Even without a big budget, the entry-level to succeed in

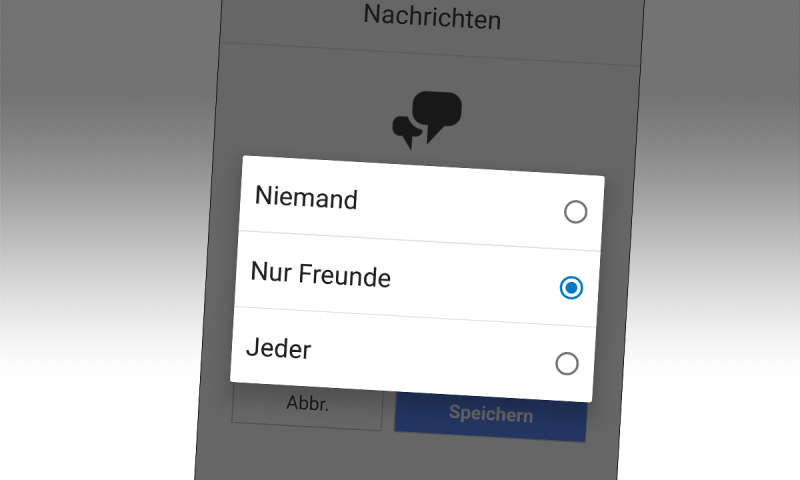

A striking peculiarity: The Fund is also available to the public. Many providers of similar products aimed at institutional investors, which are often much larger sums than normal, investors make a locker for the entry in the Fund with respect to crypto-currencies. The new Format of Investment professionals 3iQ on the TSX, the special feature is the fact that it is a complete regulation of the product – fully regulated in the sense that access for all types of Investors is possible. Who has only a small Budget, is also addressed. With a reasonable price of eleven dollars can secure investors ‘ interests. Once again big names in the crypto industry are among the partners in the case of the Emission. Among other 3iQ is called as the operator of the cryptographic stock exchange Gemini known siblings Winklevoss as part of the commander-in-chief.

A signal for approvals on other stock exchanges in the world?

The stock exchange is responsible for the safekeeping of the shares is responsible. Course signals will be obtained from the provider of crypto compare. Other partners include the company MV Index Solutions, as well as the service provider VanEck are. Good things come to those that wait – so you could put it against the Background of the long lead time to approval by Canada’s regulatory authority Ontario Securities Commission (OSC) for the Fund product. Many applications were rejected at earlier time points, a number of corrections were up to the positive testing of the final application required. Interesting is the question of whether may be also extremely critical of the US regulator, the SEC, after numerous rejections of requests to exchange-traded Bitcoin Fund (ETFs) is, in this context, now finally open, will present in the near future. Investors in Canada in addition to the Store of Coins in their own Wallets for.